Self employed tax refund calculator

This is your total income subject to self-employment taxes. Using the details provided above the calculator will try to work out the additional amount that HMRC will ask you to pay.

Tricks For Getting The Biggest Tax Return If You Are Self Employed

Calculate your adjusted gross income from self-employment for the year.

. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. Self-Employed defined as a return with a Schedule CC-EZ tax form. This Estimator is integrated with a W-4 Form.

Simple Tax refund calculator or determine if youll owe. WASHINGTON The Internal Revenue Service said. Generally construction workers claim back an average of roughly 2000 but it depends on your individual earnings and expenses.

Use this simple calculator to quickly calculate the tax and other deductions that are taken from income from self employment. If any of the following apply to you. You may be able to claim a refund if youve paid too much tax.

Freelancers others with side jobs in the gig economy may benefit from new online tool. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax.

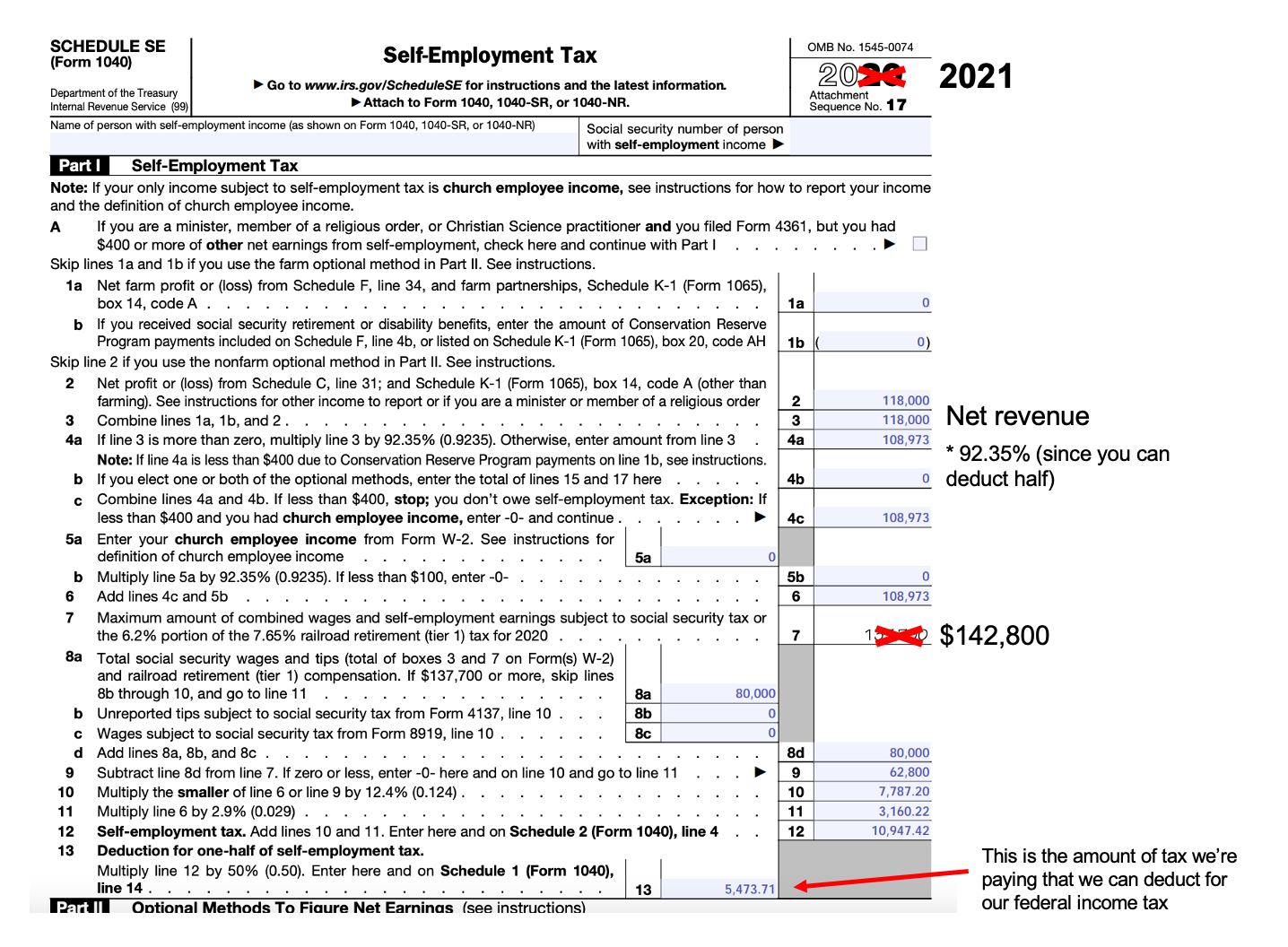

However you figure self-employment tax SE tax yourself using Schedule SE Form 1040 or 1040-SR. How does the employed and self-employed calculator work. This means that 50 of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27 2020 and ending December 31 2020 is not.

Online competitor data is extrapolated from press releases and SEC. Use the IRSs Form 1040-ES as a worksheet to determine your estimated taxes. Enter your filing status income deductions and credits and we will estimate your total taxes.

If youre self-employed the self-employed ready reckoner tool can help you budget for your tax bill. Self-Employed Tax Calculator 2021. Also you can deduct the employer-equivalent portion of your SE tax in figuring your.

This calculator gets you a full breakdown of the deductions on. IR-2019-149 September 4 2019. Self Employed Tax Calculator Expense Estimator 2021.

Our employed and self-employed calculator gives you an estimated income and national insurance tax bill based on your annual gross salary self-employment income self. Thats exactly why we have the calculator for you to use. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235.

If your self-employment income is below the small. See how to calculate self-employment tax using your work-related deductions with our self. Our employed and self-employed calculator gives you an estimated income and national insurance tax bill based on your annual.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Calculator Estimate Your Taxes And Refund For Free

Llc Tax Calculator Definitive Small Business Tax Estimator

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Self Employed Tax Calculator Business Tax Self Employment Employment

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Schedule C Income Mortgagemark Com

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download